Content

A company should disclose the cumulative effect of the change on retained earnings as of the earliest period. If retrospective application is impracticable, CPAs should disclose why and describe the alternative method used to report the change. To start off, changes in accounting principle come about when a company adopts a new generally accepted accounting principle for the prior years’ generally accepted accounting principle.

With both adjustments now made to equity, financial statement readers may be confused—that is, they may interpret a change in principle as an error correction and view the restatement negatively. Initially, companies and their auditors may need to carefully explain in footnote disclosures the exact nature of the circumstances necessitating the change. If the predecessor auditor audits the adjustment to the prior statements, the PCAOB says the reissued audit report should be dual-dated to avoid any suggestion the auditor examined records, transactions or events after that date. An audit by the predecessor auditor, however, does not relieve the successor of all responsibilities related to the adjustments. Since error corrections and changes in principles often affect the timing of when transactions and events are recognized in financial statements, the successor should obtain an understanding of prior statement adjustments.

Changes Not Affecting Consistency

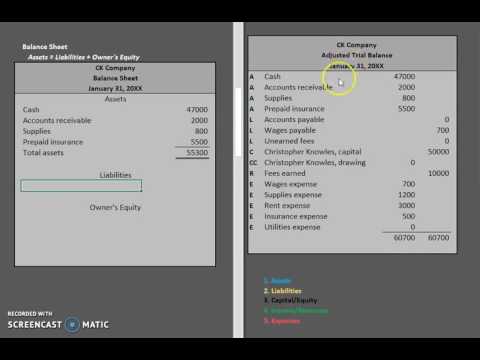

Changing an accounting principle is different from changing an accounting estimate or reporting entity. Accounting principles impact the methods used, whereas an estimate refers to a specific recalculation. An example of a change in accounting principles occurs when a company changes its system of inventory valuation, perhaps moving from LIFO to FIFO. change in accounting principle vs estimate Therefore, a change of a measurement basis for an asset from e.g. historical cost to fair value is a change in accounting policy and should be applied retrospectively. An exception to this rule relates to the initial application of a policy to revalue items of PP&E and intangible assets, which should not be applied retrospectively (IAS 8.17).

There were no other errors during 2013 or 2014 and no corrections have been made for any of the errors. Ignore income tax considerations. Assuming a 30% tax rate, the cumulative effect of this accounting change on beginning retained earnings, is a.

Standard-setting

Risks related to changes in accounting estimates must be adequately mitigated by the proper internal controls placed by the management. InventoryUnder the FIFO method of accounting inventory valuation, the goods that are purchased first are the first to be removed from the inventory account. As a result, leftover inventory at books is valued at the most recent price paid for the most recent stock of inventory.

What is the difference between a change in accounting policy and an accounting estimate?

Changes in an accounting policy are applied retrospectively unless this is impracticable or unless another IFRS Standard sets specific transitional provisions. Changes in accounting estimates result from new information or new developments and, accordingly, are not corrections of errors.