Content

Come income tax season, the payer is required to send you a Form 1099-MISC reporting all of the income they paid you the previous calendar year. This Form 1099-MISC takes the place of a W-2, which traditionally employed individuals receive from their companies. Payers are required to have these completed and postmarked by the end of January each year. An independent contractor is a self-employed individual hired by third-party entities to provide goods or services. In other words, independent contractors perform work for third parties as nonemployees.

One thing you’ll likely notice on your 1099-NEC forms is that your clients don’t typically withhold income tax from your payments like employers do for their employees. This is a pay-as-you-go system where employees typically pay their taxes throughout the year rather than all at once when they file their tax return. As a self-employed person you usually can’t wait to pay your taxes all at once either.

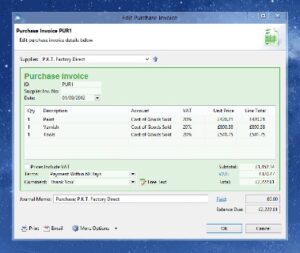

payroll – payroll for independent contractors

You’ll also need to send the form to each independent contractor no later than January 31st of the following year so that they can submit their own tax forms. For example, if January 31st falls on a holiday or weekend, the date for filing may move to the next business day. In addition to payment schedule, payment type is important when vying for the services of an independent contractor. Many today expect fast access to their earnings and may balk at the idea of receiving a check in the mail. Digital payments and prepaid pay cards are often the preferred choice of technology-savvy freelancers who may not have traditional bank accounts. Companies must thoroughly understand the relationship between themselves and their workers – are they employees or independent contractors?

- If you do not receive one from your client, it is important to request one.

- Therefore, the company should issue a Form 1099 as it would to any US resident contractors.

- Indy makes it simple for you to keep your invoices in one place so that tax season is easier to manage.

- If an individual receives an income that doesn’t come from a salary or wages, they must submit a 1099 with their tax returns.

It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. For e-delivery, a company needs to have delivered the email to the recipient informing them that their form is ready. Zenefits offers the option to prepare and store the 1099-MISC for independent contractors.

Form 1099-NEC

Generally, if you don’t have a Taxpayer Identification Number or Employer Identification Number , you should enter your SSN here. Bank products and services are offered by Pathward, N.A. Emerald https://kelleysbookkeeping.com/ Card Retail Reload Providers may charge a convenience fee. Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or Pathward.

Their signature on this form helps your business to sidestep any responsibility for the contractor’s tax requirements. In fact, once these forms are filled in, your organization carries no liability for independent contractor taxes whatsoever– even if the worker misrepresents their location or status. Freelancers, independent contractors, gig workers, and agencies don’t fall under the same category as employees, and so you don’t need to withhold taxes on what they earn. Workers who receive a regularly paid wage, such as a salary, are more likely to be considered employees, not independent contractors.

Independent Contractor vs. Employee

The formula to determine substantial presence is complicated because days in different years weigh differently. But if the contractor stays more than 31 days during the current year and more than 120 days in any preceding years, he is at risk to be taxed as a US resident. If the international contractor is considered a US resident, his compensation will be withheld at the same rate as US residents, instead of 30% for non-residents. In some countries, a worker who signs non-compete or non-solicitation agreements is an employee, because these agreements are evidence of the employer’s control over the worker after termination.

In a growing gig economy, it’s becoming increasingly common for companies to rely on freelancers, agencies, and independent contractors to complete vital roles across the business. But when handling independent contractor taxes, how much responsibility do you have as a company, and what’s left up to the contractor? Contractors are not entitled to receive benefits like health care and employer-provided Independent Contractor Tax Form Requirements workers’ compensation insurance by law. The contractor will pay their own state and federal taxes, including FICA taxes and unemployment insurance. Form 1099-NEC, which stands for nonemployee compensation, is used by the IRS to determine taxable income acquired by contractors and freelancers. Companies use the 1099-NEC to report payments to each independent contractor within a tax year.

Be mindful of how you decide to receive the payment though – some services like PayPal may charge a fee. Therefore, you’re in charge of reporting your earnings and handling your tax obligations, as there’s no employer to withhold taxes from your income. A business can also hire individuals as leased employees through a temporary agency, or a partner business in the country of origin, who hires them as employees. Then your business can have a contract with a local company offering the services of a contractor. Unlike employees, you cannot closely supervise how independent contractors work and cannot ask them to report specifics other than the work product. If you have too much control, you risk turning contractors into employees.

- In a few cases, you, as an employer, might be required to follow certain backup withholding guidelines for payments related to 1099-MISC.

- Therefore, whether you receive the form 1099 or not, the most important thing is to ensure you get your numbers right.

- We’ll even let you know whether you need to file an NEC or MISC form for that 1099.

- Foreign independent contractors earn income by providing personal services.

- Form 1099 is used to report certain types of non-employment income to the Internal Revenue Service.

Self-employment taxes are probably the most dreaded type of taxes for freelancers, as they can be quite steep. At the time of writing this , the self-employment tax rate equals 15.3% (12.4% for Social Security and 2.9% for Medicare) of 92.35% of your net earnings. Since you don’t have an employer who can withhold money from your paycheck for FICA taxes, you need to do it yourself. Another form you need to file with the IRS is Schedule SE — i.e. the self-employment tax form. Navigating a cross-border contractor relationship or employment can be overwhelming for small businesses. Most of all, a solid contractor agreement that takes both legal systems into account will serve companies well.