Content

Fortunately, Synario solves this challenging problem for CFOs and their finance teams. Custom formulas and ratios (like marginal cost) can be updated based on different factors or changed across different scenarios. But be careful—relying on one strategy may only work if you have the market cornered and expect adequate sales numbers regardless of price point. Ultimately, you’ll need to strike a balance between production quantity and profit. You can increase sales volume by producing more items, charging a lower price, and realizing a boost in revenue.

Such externalities are a result of firms externalizing their costs onto a third party in order to reduce their own total cost. As a result of externalizing such costs, we see that members of society who are not included Bookkeeping for Owner-Operator Truck Drivers in the firm will be negatively affected by such behavior of the firm. In this case, an increased cost of production in society creates a social cost curve that depicts a greater cost than the private cost curve.

General FAQs on Marginal Costs

It currently costs your company $100 to produce 10 hats and we want to see what the marginal cost will be to produce an additional 10 hats at $150. However, marginal cost can rise when one input is increased past a certain point, due to the law of diminishing returns. Overall, marginal cost forms the backbone of cost analysis for businesses and broader economic modeling.

- Average total cost is total cost divided by the quantity of output.

- For discrete calculation without calculus, marginal cost equals the change in total (or variable) cost that comes with each additional unit produced.

- It incorporates all negative and positive externalities, of both production and consumption.

- Thus, the marginal cost for each of those marginal 20 units will be 80/20, or $4 per haircut.

- Fixed costs do not change with an increase or decrease in production levels, so the same value can be spread out over more units of output with increased production.

Otherwise, the company is either underproducing or overproducing, and either way that creates a loss of money. If you’re producing at a quantity where marginal costs exceed marginal revenue, that negatively impacts your profitability. If the marginal cost for additional units is high, it could signal potential cash outflow increases that could adversely affect the cash balance.

Marginal Cost Example

This is due to the spreading of fixed costs over a larger number of units and operational efficiencies. When charted on a graph, the marginal cost of producing different amounts of products tends to follow a U shape. https://simple-accounting.org/a-guide-to-nonprofit-accounting-for-non/ Costs start out high until production hits the break-even point when fixed costs are covered. If you know you can sell those doors for $250 each, then producing the additional units makes a lot of sense.

In this simple example, the total cost per hat would be $2.75 ($2 fixed cost per unit + $0.75 variable costs). However, production will reach a point where diseconomies of scale will enter the picture and marginal costs will begin to rise again. Costs may rise because you have to hire more management, buy more equipment, or because you have tapped out your local source of raw materials, causing you to spend more money to obtain the resources.

Marginal Cost Behavior

You perform a marginal cost calculation by dividing the change in total cost by the change in quantity. The marginal cost curve demonstrates that marginal cost is relatively high with low production levels, declines as production increases, reaches a minimum point, then rises again. Calculate marginal cost using the marginal cost formula, which measures the cost of producing one additional unit of goods or services provided to a customer. Marginal cost is a microeconomics concept that businesses adopt to determine cost-effective production or service levels in the short run. In inflationary times, monitoring marginal costs in your company and devising strategies becomes even more vital.

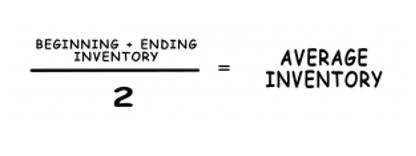

What is the formula for average cost and marginal cost?

The formula for Average cost = Total cost / Number of goods, whereas the formula Marginal cost = Change in total cost / Change in quantity.