A seasoned player may be able to recognize patterns at the open and time orders to make profits. For beginners, though, it may be better to read the market without making any moves for the first 15 to 20 minutes. Not all brokers are suited for the high volume of trades day trading generates. Check out our list of the best brokers for day trading for those that accommodate individuals who would like to day trade. Day trading is the act of buying and selling a financial instrument within the same day or even multiple times over the course of a day.

Thousands of value mutual funds give investors the chance to own a basket of stocks thought to be undervalued. The Russell 1000 Value Index, for example, is a popular benchmark for value investors and several mutual funds mimic this index. Learn how to read stock charts, and begin by picking some of your favorite companies and analyzing their financial statements. Keep in touch with recent news about industries you’re interested in investing in. It’s a good idea to have a basic understanding of what you’re getting into so you’re not investing blindly.

There are different types of trading strategies, but the most common ones are mean reversion and trend following — two opposing but complementary strategies. This website is all about quantified trading strategies and trading systems. We believe as a guide that 100% quantified rules are what fits most traders. The idea behind pairs trading strategies is to trade on the value of the spread.

If you’re new to the options market, avoid jumping into it without fully understanding how these derivative products work and what the risks are by using them. Educate yourself about options trading by reading expertly-written books and articles — your prep can help to avoid pitfalls. In the option payoff diagram above, the blue line represents the payoff of a call option position. Losses are limited to the initial premium paid below the strike price A, while the breakeven of the strategy is the point at which the diagonal line crosses the X-axis.

Remember that the goal is to eventually master a certain strategy. So when you find something that shows promise and suits you, focus on it. If you want to succeed at trading, first make sure you don’t fail. You’ve got your preferred setup in mind … Now the key is to not force it.

Top 9 Best-Performing Stocks: September 2023

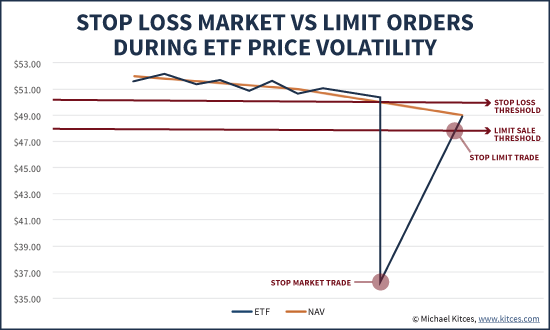

For long positions, a stop-loss can be placed below a recent low and for short positions, above a recent high. As a day trader, you need to learn to keep greed, hope, and fear at bay. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

Many successful traders may only make profits on 50% to 60% of their trades. However, they make more on their winners than they lose on their losers. Make sure the financial risk on each trade is limited to a specific percentage of your account and that entry and exit methods are clearly defined.

Trend Following Trading Strategy

You can find information about trading strategies in the article above. The best broker for futures trading should offer the right balance for an intuitive platform, low commissions, up-to-date resource offerings and excellent customer service. Here are our suggestions for the best brokers for futures trading. The breakout movement is often accompanied by an increase in volume. Here, you look for a narrow trading range or channel where volatility has diminished. Asktraders is a free website that is supported by our advertising partners.

This turns the trading bias to bullish (positively) and this creates new interest in long positions. Similar to the Stochastic indicator, the Relative Strength Index, or RSI, is looking for extreme market conditions. Scalping with the RSI works very well during more volatile market conditions, such as news events. In the gold chart, an expert scalper would have seen the negative momentum to initiate a short position at $1,510 (bid price). When prices cross below the 50-period EMA, a sell signal emerges and short positions can be established.

And they need stocks that move up or down in price, allowing them to make a profit. When people talk about forex day trading, they’re usually talking about the spot market. Forex strategies involve speculating on the exchange value of two currencies. Think the British pound is going to get stronger in relation to the U.S. dollar? This can be more appealing than the sheer insanity of the stock market. But the reality is that you can get stuck with a system that works in only ONE market environment.

Daily Fibonacci Pivot Forex Trading Strategy

Once you have a specific set of entry rules, scan more charts to see if your conditions are generated each day. For instance, determine whether a candlestick chart pattern signals price moves in the direction you anticipate. Experienced, skilled professional traders with deep pockets are usually able to surmount these challenges. Arbitrage is a transaction or a series of transactions in which you generate profit without taking any risk.

Dynamic Pair Trading: The Ultimate Profit Booster by Damien … – Medium

Dynamic Pair Trading: The Ultimate Profit Booster by Damien ….

Posted: Wed, 13 Sep 2023 02:15:26 GMT [source]

Stay on top of upcoming market-moving events with our customisable economic calendar. Traders often have differing priorities when selecting a broker depending on their level of experience and trading activity level. You will want to select a broker suitable for your particular needs and preferences. If you’re reading this blog, you’re probably active in the market (or want to be). Proper preparation can help you sort names on your watchlist and dud list. If you aren’t using your stock screener every day, you need to be.

Plan your trading

These rooms can also act as an educational and peer-based feedback tool for novice traders who can learn from more experienced traders and ask questions. The stock price plummets, american golden rules of accounting and reversal traders look to profit by going short or buying the dip. The truth is that the forex market can be unpredictable and losing is a normal part of the game.

If the strategy is within your risk limit, then testing begins. Manually go through historical charts to find entry points that match yours. Note whether your stop-loss order or price target would have been hit. Determine whether the strategy would have been profitable and if the results meet your expectations. Next, understand that Uncle Sam will want a cut of your profits, no matter how slim.

But risk tolerance is likely to change throughout your lifetime, so it’s crucial to reassess your appetite for risk regularly, especially when faced with financial or lifestyle changes. It’s not always easy for beginners https://1investing.in/ to implement basic strategies like cutting losses or letting profits run. What’s more, it’s difficult to stick to one’s trading discipline in the face of challenges such as market volatility or significant losses.

- In general, technical analysts believe that most smaller opening gaps are filled, while larger breakaway gaps tend to indicate the market will continue in that direction.

- A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance.

- The good news is that trading forex is not rocket science, so not only financial moguls but ordinary people can potentially make money.

Instead, take out a piece of paper and write down what you would have done if you were managing your position actively. More often than not, they adjust their orders because they are affected by the profit and loss figures blinking on their screens. Trading with the trend helps a beginner focus on the right state of mind necessary for consistent performance. These characteristics will help to start your trading journey on the right path. In a nutshell, we want to maximize a trader’s skill development while minimizing risk. One of the great things about trading is that your strategy can be adjusted to fit your circumstances.

Don’t be afraid to ask for help in order to discover the best strategy for your newly-established forex trading style. As a matter of fact, experienced forex players have spent a lot of time, energy, and resources into perfecting their forex trading strategies, as well as crafting plans and tactics. It is essential to stay informed, continuously learn, and practice risk management to optimize the chances of booking profits in the dynamic world of options trading. Remember that options trading involves a significant level of risk, and individuals should consider seeking professional financial advice before engaging in such activities. The strip strategy, an intricate bearish maneuver, entails the procurement of two put options for each call option sold. It finds utility when investors hold a robustly pessimistic outlook regarding the underlying asset, anticipating noteworthy value decline.

Day trading or intraday trading is suitable for traders that would like to actively trade in the daytime, generally as a full time profession. Day traders take advantage of price fluctuations in-between the market open and close hours. Day traders often hold multiple positions open in a day, but do not leave positions open overnight in order to minimise the risk of overnight market volatility.

Some months the stock will be more expensive and you’ll get fewer shares, and other months it will be less expensive and you’ll end up with more. This is less risky than trying to maximize on trends that occur in one day, as with day trading. Learn one straightforward strategy for day trading, then apply that strategy to all of these types of assets.

The general idea is to go short when prices break below support and go long when prices break above the resistance level. Any of the books on our list can help you learn day trading, but on their own, they probably won’t give you the in-depth understanding you would need to make a profit from this risky strategy. You may decide to take a course with added features such as chatrooms, stock simulators, and mentors, or consider a different trading style. DiPietro explains how to know if you’re prepared to day trade, both monetarily and with experience. He also writes about how to set stop-loss orders so you don’t lose too much money, how to pick the right stocks, and what a bad trading day looks like. However, day trading well enough to make a profit is not as simple as it seems.

A trading style is your preferences while trading the market or instrument, such as how frequently and how long or short-term to trade. A trading style can change based on how the market behaves but this is dependent on whether you want to adapt or withdraw your trade until the conditions are favourable. You can find a list of the best three day trading strategies above. Check out our selection of the best online brokers for day traders.

Sadly, some traders try to squeeze every last penny, fail, and quit. If you want to make a profit, invest in realistic expectations, trading education, and consistency instead. In fact, exploring the complexities of trading psychology is key to establishing a profitable strategy. Once you’ve learned how to control your emotions and your impulsiveness, only then you can think of developing a trading strategy.